The strike prices are listed down the rightmost column. The leftmost column gives us the most recently traded prices for each strike price. Here is a call option chain for Google (GOOGL) for the March 18 expiration. But who wants to risk $5,000 to buy one call contract on Google that expires in two weeks? We all have come across situations where we see a great opportunity to buy calls or puts on a stock that trades above $1,000 a share. My maximum possible profit is the difference between the strike prices minus the debit I paid, or: If the price drops below $50, I lose the $0.25 I paid up front to initiate the trade. This chart combines the previous two charts, where the blue line represents the payoff at expiration. This creates a payoff graph that looks as follows: $1.00 debit I paid for the $50 strike call option – $0.75 credit I received for selling the $51 strike call option = $0.25 net debit. Now, when I combine these two actions - buying the $50 strike call option and selling the $51 strike call option - I’m left with the following:

If the price goes beyond $51.75, I lose money. If you follow the blue line in this payoff graph, you can see how I can achieve a maximum profit of $0.75 for any price below $51 at expiration. Here’s what selling that option by itself looks like. I can sell an option further out of the money to lower that cost.

#Debit credit spread full

If the price goes beyond $51, I make money.Īssume I don’t want to pay that full $1. You can see that for any price $50 and under, I lose that $1. In this chart, the blue line represents the payout diagram at expiration for a $50 strike price call option that costs $1. I want to buy a call option on ABC that costs $50. You can think of an option debit spread as a way to buy a call or put option and then sell a further out-of-the-money option of the same type to lower the cost of the trade.

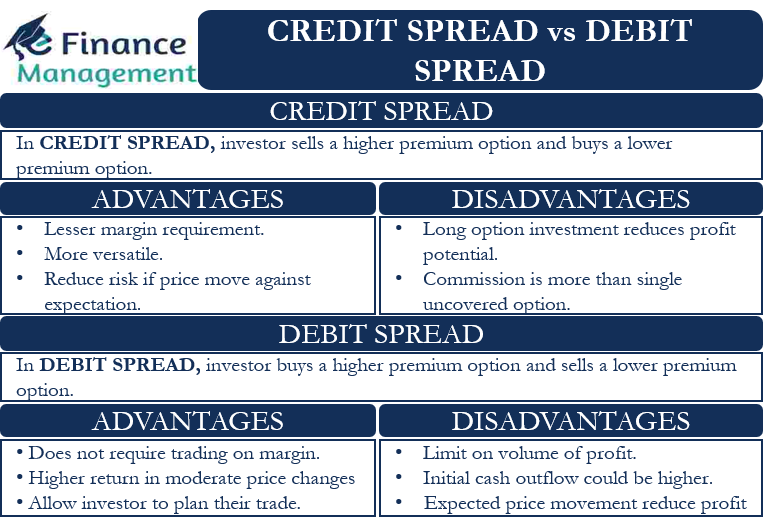

You sell an offsetting call option for the same expiration at a higher strike price.In-the-money debit spreads work a little differently, and we’ll discuss those at a later date. Unlike option credit spreads, the clock works against you with out-of-the-money option debit spreads. This is the maximum amount you can lose on the trade. When you initiate an options debit spread, you pay a debit. Option debit spreads are the exact opposite of credit spreads.

#Debit credit spread how to

Today’s newsletter explains how to construct debit spreads and the best times to use them.Īnd if you stick with me until the end, I’ll give you a few ideas to get you started. Option debit spreads can help you lower the cost of buying a call or put option when you want to make a directional bet on a stock, if you’re willing to cap your gains. However, a lot of you have asked me to explain how option debit spreads work, and rightfully so. They’re one of my favorite ways to create a trading edge and generate income. The last few weeks, I’ve spent a lot of time covering option credit spreads. I want to change things up a bit in today’s newsletter.

0 kommentar(er)

0 kommentar(er)